-

A new

mission-driven

investment opportunityAcanthus aims to raise $100 million to develop and operate senior living facilities that provide high-quality, faith-based living environments for Catholic seniors.

-

Faith-based living environments

for seniors.The objective is to meet the growing demand for senior housing, enhance community engagement, and generate sustainable revenue for Catholic Parishes.

ACANTHUS ASSISTED LIVING FUND I, LLC

The Acanthus Fund offers a rare opportunity to invest in senior living communities developed on land owned by the Catholic Church, adjacent to active parishes across Arizona. Through an exclusive collaboration with the Catholic Diocese of Phoenix, the Acanthus team has secured 90-year, fixed-rate ground leases for each building site. As of March 2025, five ground leases have been executed, with an additional 15 sites under Letter of Intent within the Phoenix MSA. With 171 Catholic parishes statewide, the Acanthus team aims to build at least 20 communities within its first 10 years. This programmatic, scalable development strategy positions the Fund for sustained long-term growth, with the potential to expand to as many as 100 communities across Arizona.

The collaboration between Acanthus Senior Living and the Catholic Church aims to develop premium senior living communities that address a vital societal need while fostering community engagement. This dynamic is designed to deliver attractive financial returns for investors, aligning social impact with financial success.

Investment Highlights

The Fund is structured to prioritize Investor interests, offering an above-market preferred return and targeting a timely return of capital before any developer profits are realized. In addition, following a return of Investor capital and payment of preferred return, Investors will continue to participate in 25% of the Net Cash Flow from future developments for the duration of the 90-year ground leases.

Targeted Capital Raise

An estimated $60M of initial capital is needed to fund and complete the first five projects, reflecting an 80/20 capital structure with the sponsor. As new ground leases are secured, additional capital will be raised up to the Fund’s $100 million target cap.

WE PUT OUR

INVESTORS FIRST

15%

Preferred Return

3-5 Years

Targeted Return of Capital

1.75x

5yr Equity Multiple

25%

Profit Share of Net Cash Flow*

*Following return of capital and preferred return

First 5 Properties

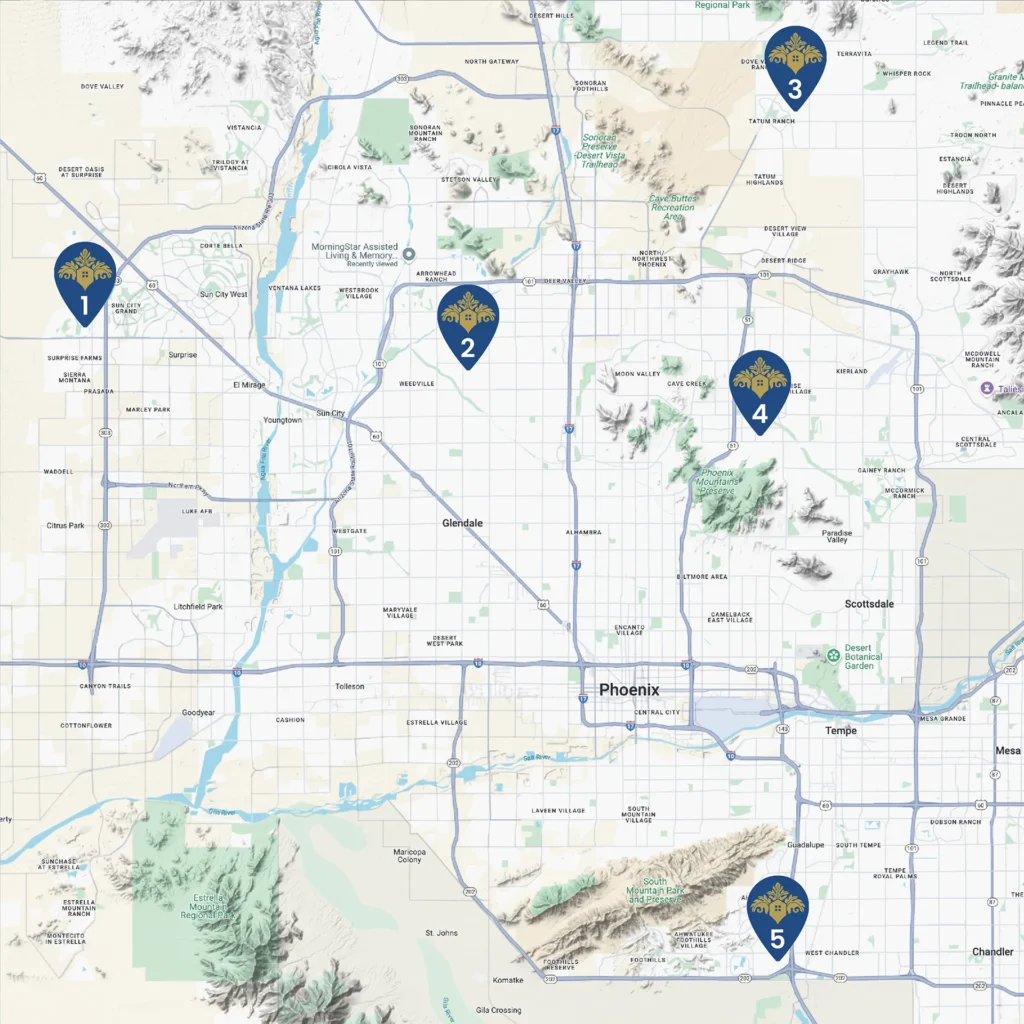

Acanthus Senior Living, in collaboration with the Catholic Diocese of Phoenix, has strategically selected the following parishes as the initial ground lease sites for the development of the Fund’s first five communities:

1 – St. Clare – Surprise

2 – St. Raphael – Glendale

3 – St. Gabriel – Cave Creek

4 – St. Joseph – Phoenix

5 – St. Benedict – Phoenix

These five sites were selected based on geographic diversity, strong parish engagement, and their advanced readiness for development. The next 15 sites under letters of intent have also been strategically chosen to ensure balanced expansion and avoid geographic over-concentration.

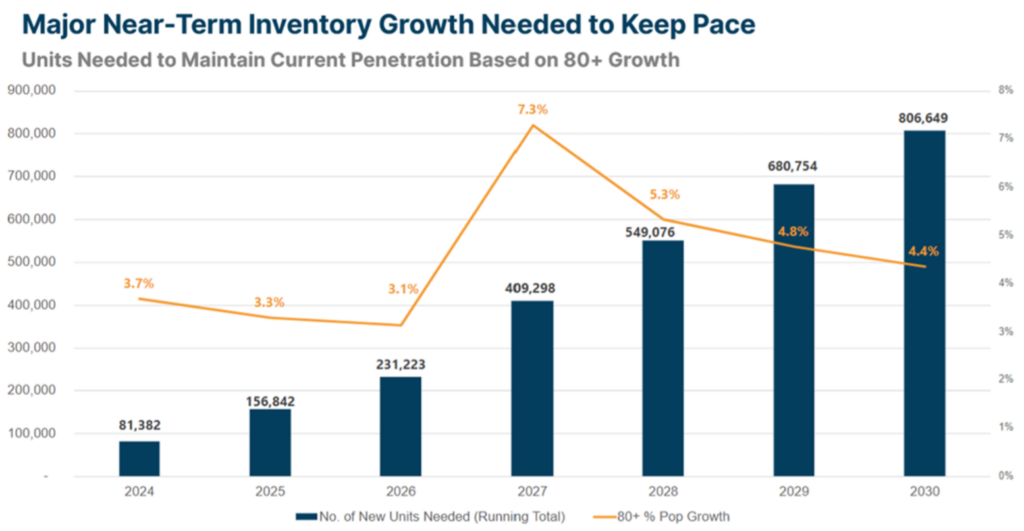

Market Opportunity - Senior Housing

Senior housing is widely regarded as one of the most attractive sectors for real estate investment in today’s market. With robust growth projected over the next decade, the sector is well-positioned to remain resilient relative to other asset classes.

High Demand with Low National and Local Supply

• 73M Baby Boomers – 10K per day turn 80 years old starting January 1, 2025

• Senior population is projected to grow from 55M to 80M over the next 20 years

• Estimated 900K Seniors live in Phoenix with only 30K Senior Living units in total market

• Limited new supply of < 1000 units under construction, representing 3% of existing inventory

• An estimated $1 Trillion in new development will be required to meet the growing demand

Key Acanthus Differentiators

STRATEGIC LAND COLLABORATION

• Rare cooperation with the Catholic Church – 2nd largest private landowner in the world

• Proprietary 90-year auto-renewing ground leases

• No rent escalations for the entire 90-year lease term

• Five leases signed in prime locations with 15 more in LOI negotiation

• No land acquisition costs and streamlined operations are projected to achieve a 13% return-on-cost at stabilization

• Strong relationship fosters accelerated city approvals and community support

CATHOLIC RELATIONSHIP - LEASING AND MARKETING ADVANTAGE

• Catholic affiliation expected to drive higher occupancy with perpetual demand from a built-in, engaged audience

• Low advertising and leasing costs due to organic, community-based marketing efforts promoted within each Parish

• Labor advantage with mission-driven personnel wanting work at facilities next to Parishes

• 1.2M Catholics in the Phoenix MSA, 240K of whom are seniors

• Estimated 9K Catholic seniors living in assisted living today

• Projected to pre-lease at an accelerated rate prior to delivery

WORLD CLASS FACILITIES –

BUILT WITH DIGNITY

• Proof of concept – Phoenix Catholic Diocese directly selected the developer based on two award winning facilities that serve as the the prototype for all future facilities

• Award winning interior design by Luann Thoma-Holec

• All best-in-class communities will feature 150 units and 180 beds, offering independent living, assisted living, and memory care

• Each community will maintain high staff-to-resident ratios, ensuring high quality service and personalized attention through dedicated care teams

• Communities feature bright, warm, and modern living spaces, along with wide hallways, dedicated activity rooms, a fitness center, beauty salon, and a centrally located nurse’s station

• Exceptional culinary services complemented by a modern exterior design featuring spacious walkways, landscaped courtyards, and private balconies

EXPERIENCED DEVELOPER AND OPERATOR

SEASONED DEVELOPER

• Bart Shea – CEO of Acanthus Group

• 40 years of experience in development, construction, management and operations

• Over 10,000 units and $900M of projects completed

• Has developed 3 senior living projects in Arizona totaling 418 units, with another 152 units currently in development

• 100+ years of combined development experience across the team

SEASONED MANAGEMENT AND OPERATIONS

• Eric Gruber – Chief Operating Officer of Acanthus Management

• 35-year experienced property management owner and president

• Former Co-Owner of Cadence Living – Built, leased, and operated 34 facilities in 9 states

• Former executive of Cogir, a top 25 senior housing owner and management company

• Executive team with over 100 years of combined management experience

CURRENT PORTFOLIO AND PROVEN TRACK RECORD

Proof of Concept: Bart Shea, CEO of Acanthus Development, has designed, built, and operated three premier senior living communities in Arizona, with a fourth currently under construction. The proven design and construction approach used in these projects will be replicated for each new development within the Acanthus Fund. Each project is a testament to Bart’s commitment to creating high-quality living environments for Arizona’s growing senior population.

Morning Star Fountain Hills

16800 E Paul Nordin Pkwy

Fountain Hills, Az 85268

91 Luxury Senior Living Apartments

63 Assisted Living (IL included)

28 MC/DM

Built in 2016

Occupancy 91%

Morning Star Golden Ridge

6735 W Golden Lane

Peoria, Az 85345

144 Luxury Senior Living Apartments

38 Independent Living

71 Assisted Living

35 MC/DM

Built in 2018

Occupancy 90%

Maricopa Senior Living

44400 W MLK Jr Blvd

Maricopa, Az 85138

152 Luxury Senior Living

152 IL/AL units (All Independent Living with ability to provide services for AL)

To be built 2025-2026

01/LEADERSHIP

ACANTHUS MANAGEMENT TEAM

The Acanthus executive team is comprised of seasoned industry professionals with deep expertise in senior housing development, management, and operations. Their collective experience is instrumental in driving the successful execution of the Fund’s investment strategy.

Bart Shea

CEO

Acanthus Group

CHRISTOPER BAYLEY

COO

General Counsel

Fund Manager Acanthus Group

Eric Gruber

COO

Acanthus Management

Maria Aguirre

CFO

Acanthus Group

02/LEADERSHIP

SUB-ADVISOR – VENTURE ADVISORY, LLC

Venture Advisory LLC serves as the Sub-Adviser to the Fund, working in collaboration with the Fund Manager to oversee fund administration, investor relations, and overall strategic direction.

Patrick O’Meara

Founder & CEO

Venture Advisory

Patrick Ventures FO

Nick Martinez

Managing Director

Venture Advisory

Patrick Ventures FO

Kayla Sladwick

Managing Director

Venture Advisory

Patrick Ventures FO

Laura Simione

Head of Capital Development

Venture Advisory

Patrick Ventures FO

OFFERING TERMS

Rotate phone to view full table

| ... | ... |

|---|---|

| TARGET FUND SIZE | $100,000,000 |

| INVESTMENT MINIMUM | $100,000 |

| UNIT PRICE | $1000 per unit | FUND STRUCTURE | Reg D 506 (c) | ELIGIBILITY | Accredited Investors | SPONSOR COMMITMENT | $15,000,000 | FUND TERM | Evergreen Fund | TARGET RETURN OF CAPITAL | 3 to 5 years | PREFERRED RETURN ($1M MINIMUM) | 15%* | PREFERRED RETURN (<$1M) | 12%* | PROFIT SHARE | 25% Net Cash Flow from future projects following return of Investor principal and preferred return | MANAGEMENT FEE | 2% of Invested Capital annually | MARKETING FEE | 1% of Invested Capital (First Year only) | PROMOTE** | SPONSOR 5% • SUB-ADVISOR 5% |

*Fund Manager Discretion

**Promote not received until investors’ return of capital and accrued preferred return

Operational Overview

Legal

Fund Administration

Banking

Accounting

FUND DECK

Please fill out the form below to access the Acanthus Fund Deck.